5 Best Instant Loan Apps in the US in 2022 | Instant app for $50 loan

Do you need to pay some bills but can’t wait for your paycheck? Well, we understand this situation and that is why we have prepared this article in which we have shared a list of the best $50 instant loan apps that you can use to get $50 to $100 instant cash loan immediately.

So, without further ado, let’s get started:

Top 5 Instant Loan Apps for $50 in 2022

The apps mentioned below can be considered a $50 instant loan app as they can easily offer you $50 to $500. The best thing about these apps is that they don’t have a strict document verification process and are pretty easy to use. In addition, they offer instant loan repayment.

So here are the top 5 best apps for instant loans between $50 and $100.

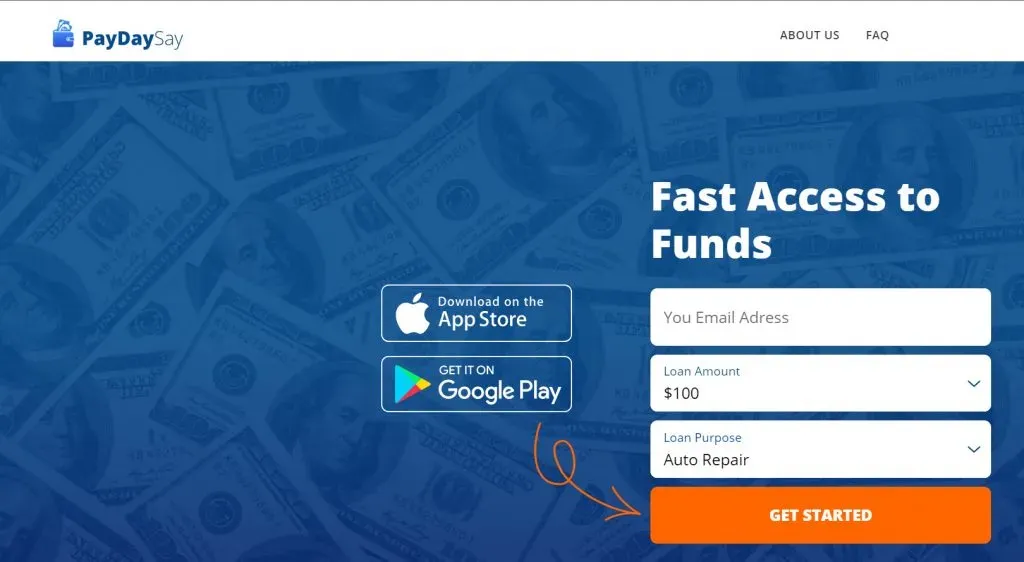

PayDaySay is the best $50 instant loan app

The very first instant loan app on our list is PayDaySay. It is currently one of the most popular instant loan apps that offers you to borrow up to $5,000. It is designed to help people solve their immediate financial needs. In addition, it allows you to apply for an instant loan without leaving your home.

PayDaySay offers loans ranging from $100 to $5,000. You can apply for a loan for almost any purpose, such as car repairs, credit card or debt consolidation, home improvement, medical expenses, emergencies, and more.

In order to receive an instant loan amount from PayDaySay, you need to have a good credit history, credit score and steady employment. Self-employed individuals may not be able to get a loan from PayDaySay.

Rates and APR vary from lender to lender, ranging from 5.99% to 35.99% per annum. However, you can quickly get a loan at 10-15% per annum if you have a good credit history and a steady job.

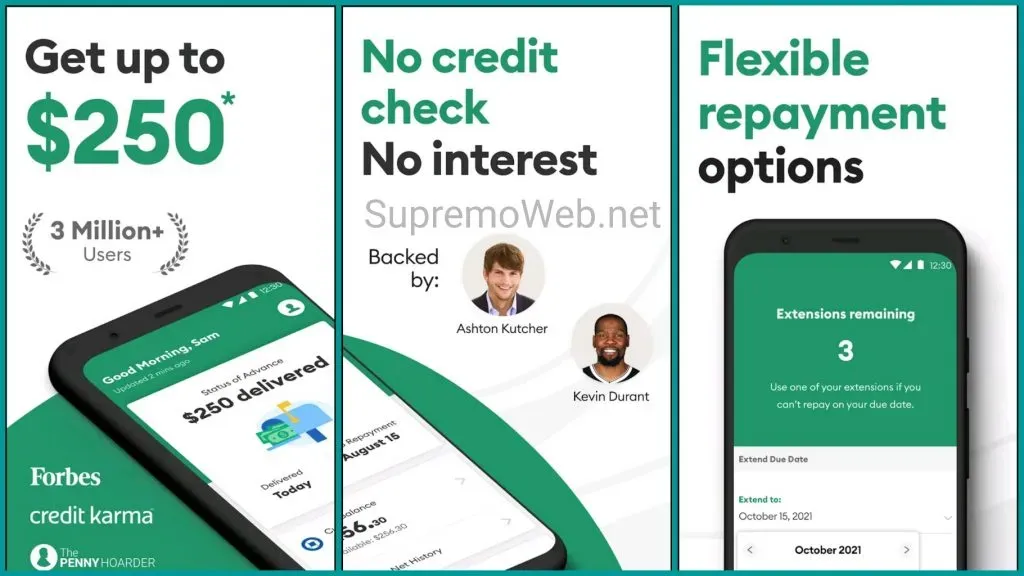

Brigit – money loan app

Next on our list is Bridget. This is another useful instant loan app that can help you deal with unexpected funding needs. The best thing about Brigit is that the application process is completely digital, which means you can apply for an instant loan from the comfort of your home or office. It also eliminates the need to carry paper documents to banks for verification.

Brigit is trusted by over 3 million users and boasts an excellent 4.7 star rating even after 250k reviews. This shows how trusted Brigit is among its users. The best thing about Brigit is that the application process is hassle-free and barely takes a couple of minutes.

In addition, the money will be credited to your account within the same business day. Another good thing about Brigit is that it’s a great app for first-time borrowers as it doesn’t require your credit check and allows you to create your first line of credit and maintain a healthy credit report.

It is basically an instant $50 loan app where you can get up to $250 before your next paycheck. The app is safe and secure and boasts features to help you keep track of your expenses, budgets, savings and more. You also get real-time alerts for all your bills and upcoming contributions.

Dave – Instant Money Applications

Dave is another instant loan application very similar to Brigit. This app is designed to help users reach their financial goals and help them with their day to day money needs. With Dave, you can instantly get a loan ranging from $50 to $500. The whole loan application process is online and hassle-free.

One of the reasons Dave is on this list is because of how much trust he has gained among his users. For example, it has over 10 million downloads from the App Store and Google Play Store combined, but has an excellent 4.6 star rating on the Google Play Store and a 4.8 star rating on the Apple App Store. This shows that Dave is a reliable lender.

The process of applying for a loan is quite simple and convenient. All you have to do is download the app and start filling out the application form. Even though Dave says he doesn’t check your credit report, he does use your bank account to check your creditworthiness. However, this is a mandatory process, as no application will want to lend money to someone who does not return it.

Dave charges you $1 per month as a maintenance fee. $1 doesn’t really matter as it doesn’t ask you for the purpose of borrowing the money and offers a hassle-free loan repayment process. However, Dave wouldn’t be the ideal choice in the long run.

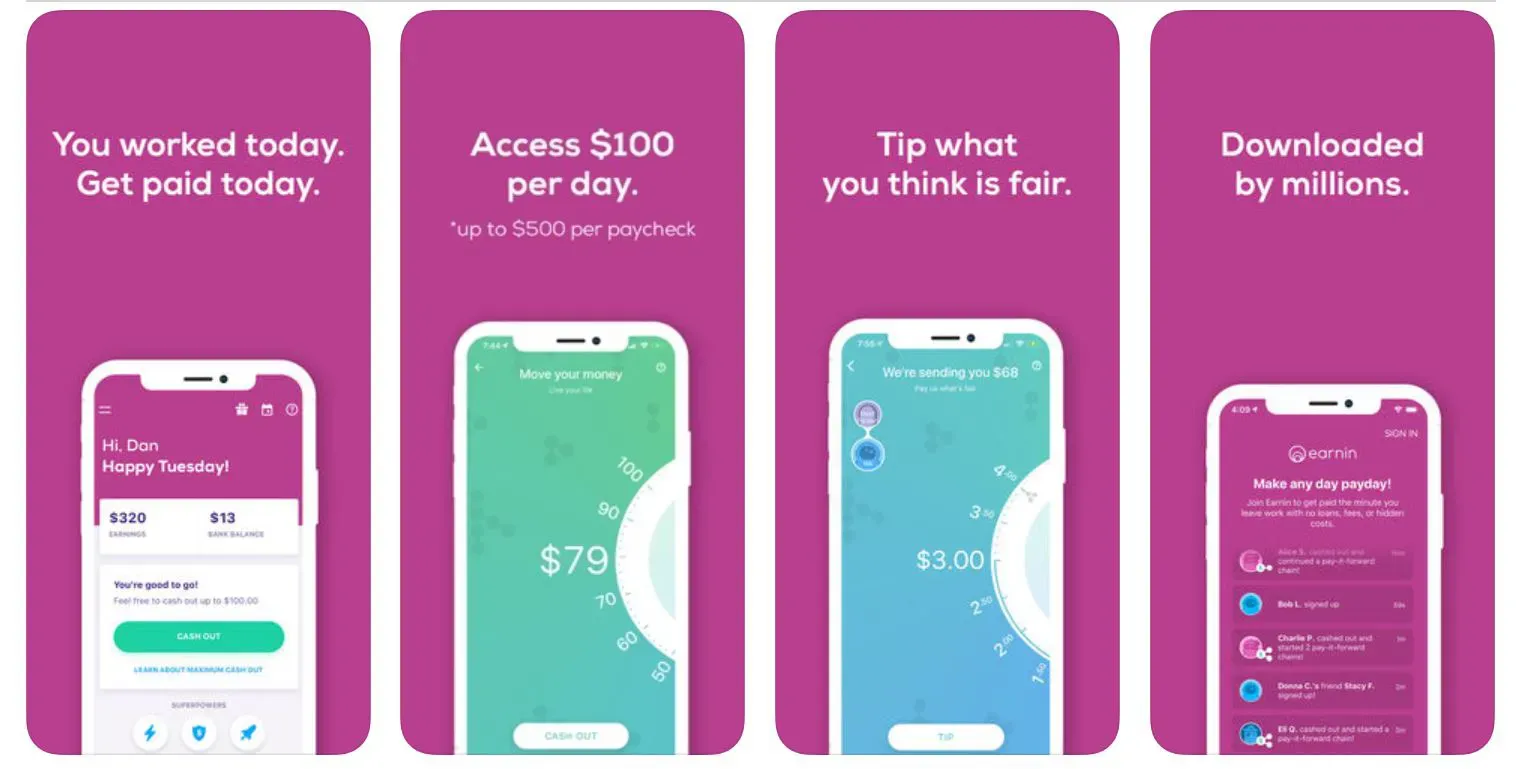

Earnin – the best applications for instant money

Earnin is an application that is mainly suitable for people who work on a salary. This app is quite popular among people who want to borrow a small amount of money before payday. This can easily help you get a $50 to $500 loan.

The loan application process is quite simple and effortless. The whole process is online, and the money is credited to your bank account in just an hour. However, he only gives you a loan against your next paycheck, so keep that in mind. Another good thing about Earnin is that it does not apply any hidden fees.

You must link your payroll account to Earnin in order to receive a loan from it. Once you link your payroll account and verify that you have a full-time position, the loan amount will automatically be credited to your checking account and will be automatically debited upon receipt of your next paycheck.

Empower – instant cash withdrawal app

Finally, we have Empower on our list. Similar to Earnin, it also offers a convenient instant loan service where you can get up to $100 in no time. It also has a similar model where you have to confirm that you have a permanent job and that’s it.

The best thing about Empower is that it offers you an instant loan with 0% interest rate. However, you must ensure that you pay off the loan amount on your next payday. Otherwise, the annual rate will skyrocket to 35.99%.

The application process is quite simple and effortless. All you have to do is download the app on your smartphone and fill out the application form. Other than information about your employment, Empower does not ask for or verify anything, such as your credit report or anything else.

If you use Empower on a regular basis and pay all your bills on time, you can increase your line of credit up to $1,000, which is great. Moreover, it will also help you build your credit history over time. All in all, this is a great application for an instant $50 loan.

Conclusion

That’s it – a list of the best instant loan apps in the US for 2022. Sudden financial disruptions can make a big difference, but fixing them is impossible unless you need thousands of dollars. If you are in need of an instant cash withdrawal app for, say, $50 to $500, these $50 instant loan apps can be a very good solution for you. This is where I end this article. If you have any questions feel free to ask in the comments section below.

Leave a Reply