Lydia, the new bank that supports you every day

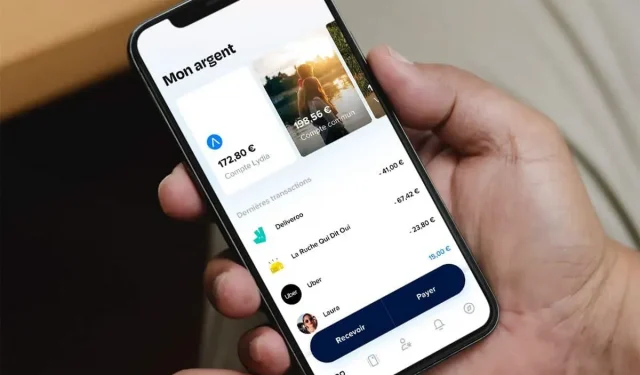

Lydia wants to reinvent the bank to put it in the hands of users, a 100% mobile solution tailored to all needs.

Lydia, whose name is inspired by the kingdom of Lydia, where the first coins were minted and whose last king was none other than Croesus, was launched in 2013 in France by Cyril Chiché and Antoine Porte with the aim of making it easy to pay for everything, quickly and securely with smartphone. Today, the platform has at least 5.5 million users worldwide. Presentation.

Lydia wants to reinvent the bank to put it in the hands of users

Since 2013, Lydia has continued to expand its service. At that time, it was only about exchanging money between people using their smartphones. Small Express Loans arrived in 2018, loans ranging from 100 to 3,000 euros with maturities of 3 to 36 months, no hidden costs, directly accessible from the app and with an immediate response. At the end of 2020, Lydia Bleu and Lydia Noir paid subscriptions arrived, making Lydia a true checking account with Visa card, French IBAN, and paid savings solution. And since spring 2021, Lydia has offered a “buy now, pay later” payment option for three times the payment across all stores, physical or online.

Today, Lydia is a fully trusted alternative to traditional banks and the reference app for people-to-people payments. The service is based on three main principles. The first is simplicity and accessibility – a simple smartphone is enough to open an account. The second is transparency. No hidden costs, as traditional banks may practice, everything is clearly stated. Special fees may apply – limited quantities – however the list is also clearly stated. Finally, one of the mottos of recent years is safety. A young player in the market, Lydia must meet the same financial authorities and the same requirements as the big banks.

100% mobile solution adapted to all needs

Individuals have a choice between three subscriptions:

- Free Lydia is an offer for casual users who want to take advantage of Lydia’s flagship features: mobile payments, free international payments, 3 internet cards, French RIB, instant transfers, unlimited accounts, express credit, money sharing. Addition, jackpot no commission, connection to your bank, account alerts. Payments are limited to 20 transactions per month for a total transaction value of €1,000. Automatic participation in the Lydia kitty program, which refunds the payment for every 1000 payments made, all users combined.

- With Lydia Bleu – 4.90 euros per month or 49 euros per year – the subscriber has a checking account with a Visa card and a French IBAN, a limit of 5000 euros per month without a limit on transactions, savings paid out at 0.6%, credit and payment options., secure online payment via a temporary internet card, contactless payment via the app, sub-accounts, foreign transactions without commission.

- Lydia Noir – 7.90 euros per month or 79 euros per year – this is the ultimate subscription, so to speak, with exceptional benefits: a checking account with a free Visa card and a French IBAN, instant and free bank transfers, a ceiling of 50,000 euros per month, up to €1,000 withdrawals without commission even abroad, pools without commission, secure online payments via temporary internet card, pool accounts, instant loans, concierge, fraud insurance, online purchase protection, travel insurance, repatriation insurance, winter sports insurance sports.. .

Professionals are not forgotten either, as Lydia offers a professional offering that turns phones and tablets into real ATMs. Thus, merchants can process and collect payments online or at the point of sale using QR codes, bank cards or the Lydia app.

Including those who want to trade

While the world of investments and the stock market are still obscure to many French people, the recent craze for cryptocurrencies is attracting new investors. And as Lydia aims to make it easier to access financial services, the platform had to offer merchant services as well. To do this, he has joined forces with Bitpanda, founded in 2014 in Vienna by Eric Demuth, Paul Klanschek and Christian Trummer, to take advantage of a secure and reliable technical infrastructure for its partnerships with neo-banks, multi-apps, banks and regular companies.

In this way, Lydia allows you to invest in companies and cryptocurrencies from 1 euro in a wide variety of assets, whether they are cryptocurrencies or American and European companies and all CAC 40. All this. With lots of information and graphics and directly in the Lydia app, available once your Lydia profile has been verified. Obviously, users can use the money on their Lydia account and withdraw it instantly and securely. Investments are possible 24 hours a day, 7 days a week, regardless of the opening and closing of the market. Moreover, Lydia does not apply any hidden fees: Lydia tries to keep the spreads as tight as possible, which allows her to offer very attractive prices.

If you’re curious, know that Lydia is currently offering its Lydia Blue subscription for just €1 per month for users under 25, with two months free for any annual subscription.

Leave a Reply