Benefits of using digital wallets

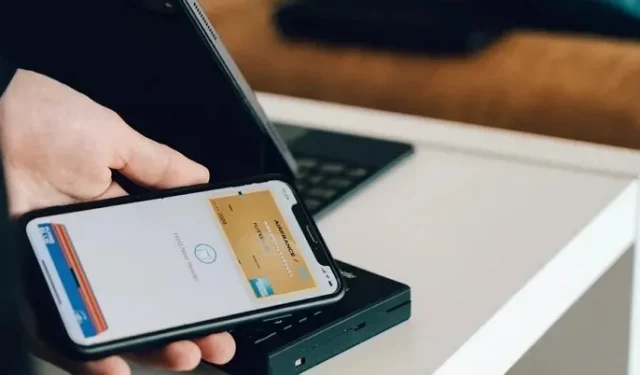

Whether you run your own business or are just a customer, the recent boom in the use of digital wallets (or e-wallets) has been good for everyone. Some notable examples of this product include Apple Pay, Google Pay, PayPal, Skrill, and Neteller. Digital wallets can be used to transfer money between different accounts and different platforms, for real transactions, and of course, for transactions that take place online. The fact that they can be applied to so many disparate situations is what makes them so popular and widely used.

Let’s take a closer look at some of the outstanding benefits of using an e-wallet in today’s world, rather than more traditional payment methods.

Safety and security

One of the top considerations for e-wallet users is the increased security that many leading providers promise. When using a digital wallet to pay for a product or service, or to sign up for a subscription, customers do not need to share all of their personal information with the merchant. Rather, with their e-wallet, the transaction can take place in a secure and controlled system, and the trader does not need to access the client’s data or their money. This security is raised to an even higher level if the client uses a cryptocurrency wallet for payment and uses blockchain technology.

Ease of use

There’s no doubt about it – with a wide range of applications, digital wallets are simply easier to use than traditional payment methods. For example, they are one of the popular casino deposit methods.and is used by online gamers. Whatever your favorite game, most online casinos encourage their customers to use digital wallets because they know they are safe, secure and easy to use. While you might think that PayPal will reign supreme this quarter, in fact the most popular e-wallets for this activity are Skrill and Neteller. A wide range of operators accept both of these digital wallets, offering a convenient way to access your money online without activating frequent bank transfers. The site has additional information about various payment methods and popular ones.

Another example of the ease of use of digital wallets is the increased adoption of digital wallets for conventional subscription models such as Netflix, O2 phone contracts, or Estrid shaving kits. The ease of accessing e-wallet accounts anytime, anywhere means customers have full control over their subscriptions and know when money is leaving their account.

Availability

Speaking of accessibility, e-wallets can provide access at home on a PC or laptop, on the go via mobile devices, and even via wearable devices such as Apple watches and FitBits. People are more likely to forget their physical wallets than their phones these days, so accessing a digital payment method with this most popular technology is a huge win. It also means that no matter where you are, you can still access your money and, in many cases, pay without any exchange fees. Digital wallets like Apple Pay and PayPal are used all over the planet and will do any currency conversion for you at no extra cost.

More control

In a world that is increasingly moving to a 24/7 operating mode, it is not profitable for customers if their regular bank is still operating as usual. Using a digital wallet often means you can resolve issues, make account changes, access funds, and make deposits at any time of the day or night, rather than waiting for a bank to open downtown. Using an e-wallet also means that you, as a customer, can receive instant, real-time updates if something happens on your account. This means attempts at scams or other nefarious activities can be detected and dealt with much faster, making it easier for you to keep track of your spending.

Provider selection

While there are a finite number of established banks in the world, the number of digital wallet providers is much larger. This means that customers can use one or more for different purposes, or even easily switch between them to get the best deals and compatibility. While this may mean that the services of some smaller operators are not as high quality, there are indeed many big players in the industry that offer strong security measures (as mentioned above) combined with more flexibility than traditional banks and payment methods. The bottom line is that the choice is up to the buyer, and the pool for choice is much more diverse.

Overall, the e-wallet or digital wallet is clearly not going anywhere. When used correctly, this product can be of great service to both consumers and business owners, giving everyone more peace of mind and access to faster and more secure transactions, wherever and whenever they need to.

Note. When making an online payment, make sure that you can trust the website and that it is completely secure. Although the reports talk about the benefits of digital payments, if you are not careful, you will end up losing money.

Leave a Reply