Social media for banks and credit unions: 7 tips

As a marketer working in the financial services industry, you know that navigating social media bank accounts can be tricky. Balancing regulatory requirements with creative ideas for effective content marketing is no small feat. This becomes even more difficult if you manage multiple channels.

Luckily, we have some helpful tips to make your job easier. Whether you’re looking for new ways to get customers on Instagram, build brand awareness on TikTok, or just trying to figure out what tactics work best on Twitter, these seven tips will get you started.

How social media is different for banks and credit unions

Banking is a highly regulated industry. Your social media banking strategy should be different from, say, a TikTok teenager posting their purchases at the mall.

As a marketer or social media manager who manages social media for a bank (or credit union), there are a few things you need to know. Most importantly, your content and strategy must comply with federal regulations. Or, depending on where you work, the rules of your governing body.

Financial sector laws generally treat the Internet as a marketing channel. This means that everything from your website to your social media accounts must comply with the marketing rules specific to your industry.

It is enough to think about strict laws and rules. On top of that, as a social media marketer working in the banking industry, you also need to consider social media compliance and social strategy.

Building a Social Media Strategy for Banks and Financial Institutions: 7 Tips

Creating a social media marketing strategy can often seem like a daunting task for banks and financial institutions. You have to navigate the intricacies of digital marketing. And create content that resonates.

Here are some tips to help you get started with your social media strategy.

A platform that can help you reduce risk, save time and stay organized? If that’s not easy yes, I don’t know what is.

Using one central, controlled platform for all your social media channels will help you operate more efficiently and securely, centralize compliance oversight, protect investor and consumer information, and make it easier for your team to navigate your social media channels.

Of course, we’re biased, but it would be remiss if we didn’t offer Hootsuite for your social media financial needs.

Hootsuite is a popular social media management platform for highly regulated industries due to our operational efficiencies, robust ecosystem of partner applications, customizable permissions and approvals workflows, and end-to-end compliance solutions.

In addition, Hootsuite complies with industry regulations including FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF and MiFID II.

2. Train your internal team

Include in your strategy a phase dedicated to teaching your internal social media team the rules of your industry and your own social media rules.

If your team members understand what compliance looks like, they are much less likely to accidentally post something that could get you into trouble.

Hootsuite can also make this task easier. Amplify, our employee advocacy platform, allows content administrators to direct a steady stream of pre-approved, curated content for your employees to share on their social accounts.

Amplify is a great way to expand your organization’s reach while reducing risk with brand-aligned content.

The social media management policy sets out the rules of engagement for all employees. This could be a document outlining all the “required knowledge”for your content creators. It should meet your guidelines for email, text messages, and all other customer and public communications. Your governance policy will help you operate in accordance with the rules of your industry.

Because social media governance is part of the company’s overall security and compliance policy, the Chief Information Officer and Chief Risk Officer may be involved in the creation of your social media governance policy.

Hootsuite may even partner with you to provide your employees with personalized social media management training.

Social media advertising is a great equalizer, especially for those in the financial sector. You are not limited by area codes, event invitations, or any other spatial barrier. You can contact all people with any economic status who have access to the platform.

This means you can lead Diversity, Equity and Inclusion (DE&I) initiatives that can reach a wide range of people. Maybe it’s the “Financial Literacy for All”campaign to level the playing field for investors. Or maybe you’ve noticed that you’re not reaching a specific demographic and have decided to target your campaign to them.

TD, for example, ran a campaign that used cricket, a popular sport in South Asia, to connect with the wider South Asian demographic.

DE&I initiatives will inherently help you comply (and even comply) with regulations such as Regulation B, the Equal Credit Opportunity Act.

The Equal Credit Opportunity Act states that, as a lender, you can “affirmatively solicit or encourage members of traditionally disadvantaged groups to apply for credit, especially groups that would normally not be able to apply for credit from that lender.”A properly organized DE&I campaign can do just that.

5. Create Content Columns Relevant to Your Audience

Creating content columns provides a solid foundation for your strategy. This gives you an idea of what your overall page should look like and a starting point to build from.

By focusing on topics that resonate with your audience, you provide recommendations that will keep your posts focused, creative, and relevant.

It’s important to consider the different platforms you use when deciding what content to put where, such as informative how-tos or fun polls.

If you want to make the process even easier, set up content libraries with pre-approved templates, media assets, and publish-ready content.

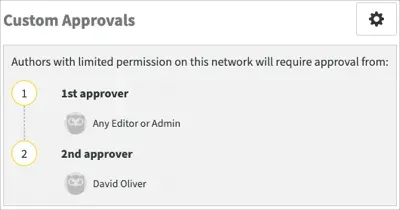

6. Set up a verification system

Having only one person responsible for creating and posting social media content is a good way to make a mistake. Create a system where people or teams must approve new posts, comments, or replies before they are published.

With Hootsuite, you can define approval workflows for each of your social accounts, so nothing will be submitted without first being reviewed by your compliance officers or an approved member of your team.

You can learn how to do this in Set up the approval process.

7. Have a backup for your backup plan

In the age of social media, having a financial institution without a crisis management plan is like sailing without a life raft: reckless and fraught with disaster.

Creating a crisis management plan is not just wise; it is important. It’s also a good idea to have plans A, B, and even C, since you can never be completely sure when Murphy’s law might rear its ugly head.

When dealing with tricky customer inquiries or slanderous social media posts, having a crisis management plan in place will help prevent malicious information spread and reassure your customers that their money is in good hands.

Great Ways to Use Social Media for Financial Institutions

Yes, there may be many rules, but that doesn’t mean there aren’t many ways to entertain your audience. Here are five ways to diversify your bank or credit union’s social media strategy.

Celebrate the triumph of your audience

Who doesn’t love being celebrated? You can shout to your audience about their milestones or achievements. You can do this in several ways.

If someone tags your account in a holiday post (like a successful mortgage application!), ask permission and then repost. We’ll talk more about user-generated content (UGC) below.

You can usually shout positive affirmations into the abyss of social media like Chime. While this may not directly affect customer relationships, it will help shape your brand as caring.

You can also take a more active role in celebrating your audience, as the Royal Bank of Canada (RBC) did with The Black Atlantic Experience.

The Black Atlantic Experience tells the stories, challenges, and triumphs of some of Atlantic Canada’s new black leaders. It celebrates the people at the center of storytelling while simultaneously exploring and addressing the issues they face, especially systemic and overt racism. Without shying away from heavy themes, these stories lend more strength to the triumphs of the subjects.

Educate your audience

Use your social media platform to improve financial literacy. You can offer your subscribers a unique opportunity to improve their financial strategies. Offer valuable advice and do it in a way that keeps you on top of your posts so they are better informed.

You’ll want to provide helpful budgeting or savings advice for the future in an easy-to-read format. Take, for example, Chime. They have created a brightly colored carousel dedicated to helping you figure out your taxes.

Use UGC to make your audience feel noticed

Brands all over the world are capitalizing on user-generated content to make the audience feel noticed. This has the added benefit of providing social credibility to your audience. Be sure to ask permission before posting content to your audience. It’s just good manners.

Today we participated in the ribbon cutting for the new US bank located in downtown Hamilton! Thanks for having us @usbank ? pic.twitter.com/KXDQBj9ABi

— Hamilton High Cheer (@HHSBigBlueCheer) November 16, 2022

Don’t be afraid of humor

Let’s face it: financial content can be dry. But that doesn’t mean your voice has to be hard and professional.

We can feel your fear through the computer; you say, “I can’t get permission to post memes on my bank’s Twitter feed.”Don’t worry. We are not telling you to use the platform for something unbranded.

Also, if you find something too complex for your brand, then it will probably look like an over-attempt. But there are so many levels of humor; you can be carefree without sacrificing professional integrity. Take, for example, the US bank on Twitter. They use light, family humor that doesn’t come off as too much.

Watch out, Bob the Builder!? https://t.co/ce98DeI8a2

— US Bank (@usbank) November 17, 2022

Now take, for example, the Plum money app on TikTok. They have a different (probably younger) audience and a different tone than the US bank. Both are light-hearted but intended for different audiences.

@plumapp it takes minutes ?

The takeaway here is to get to know your audience and your brand, and then tailor your social media voice to speak to both.

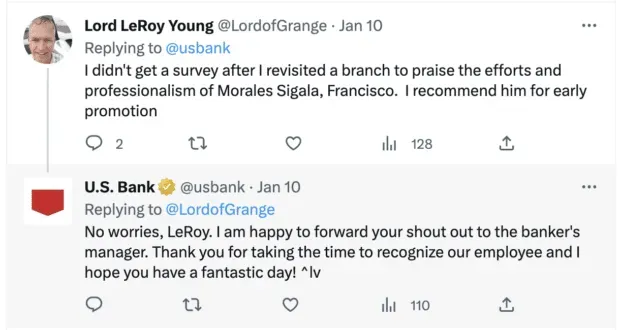

Interact with your audience

The beauty of social media is that it’s a two-way street. You are approached by people who want to participate. Good customer service isn’t just about handling complaints. Being open and receptive to conversation humanizes your institution and helps build customer loyalty.

Source: US Bank on Twitter.

Leave a Reply